For Business | Health Reimbursement Arrangement

HRA solutions for employers

Give your employees more flexibility with a seamless Health Reimbursement

Arrangement (HRA) experience powered by HealthEquity.

HRA solutions

Our solutions combine intuitive technology with remarkable service, enabling you to simplify the experience and empower your people to achieve more.

Customize your HRA

With a customizable experience centered on your business goals and challenges, you can:

Reward healthy decisions

Encourage your employees to make healthy lifestyle choices with a Health Incentive Account (HIA). HIA funds can be used to reimburse eligible healthcare expenses, including dental and vision, making it even easier to afford care. HIAs are highly configurable and you can restrict eligible expenses based on program needs. You can reward employees for completing healthy activities such as:

- Smoking cessation

- Meeting fitness goals

- Adopting better eating habits

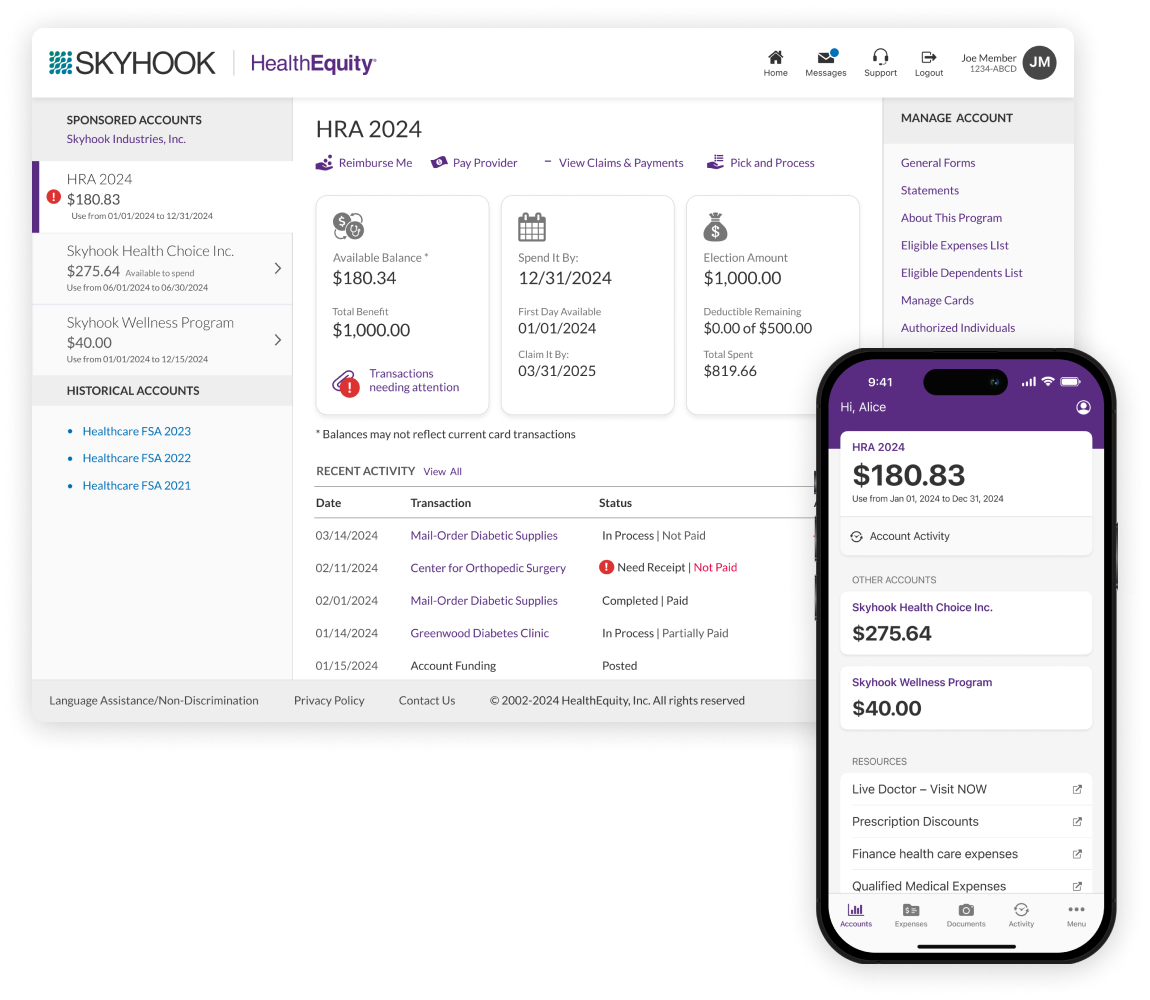

Single-view dashboard

Our unified dashboard lets members perform basic account functions directly from the home screen.

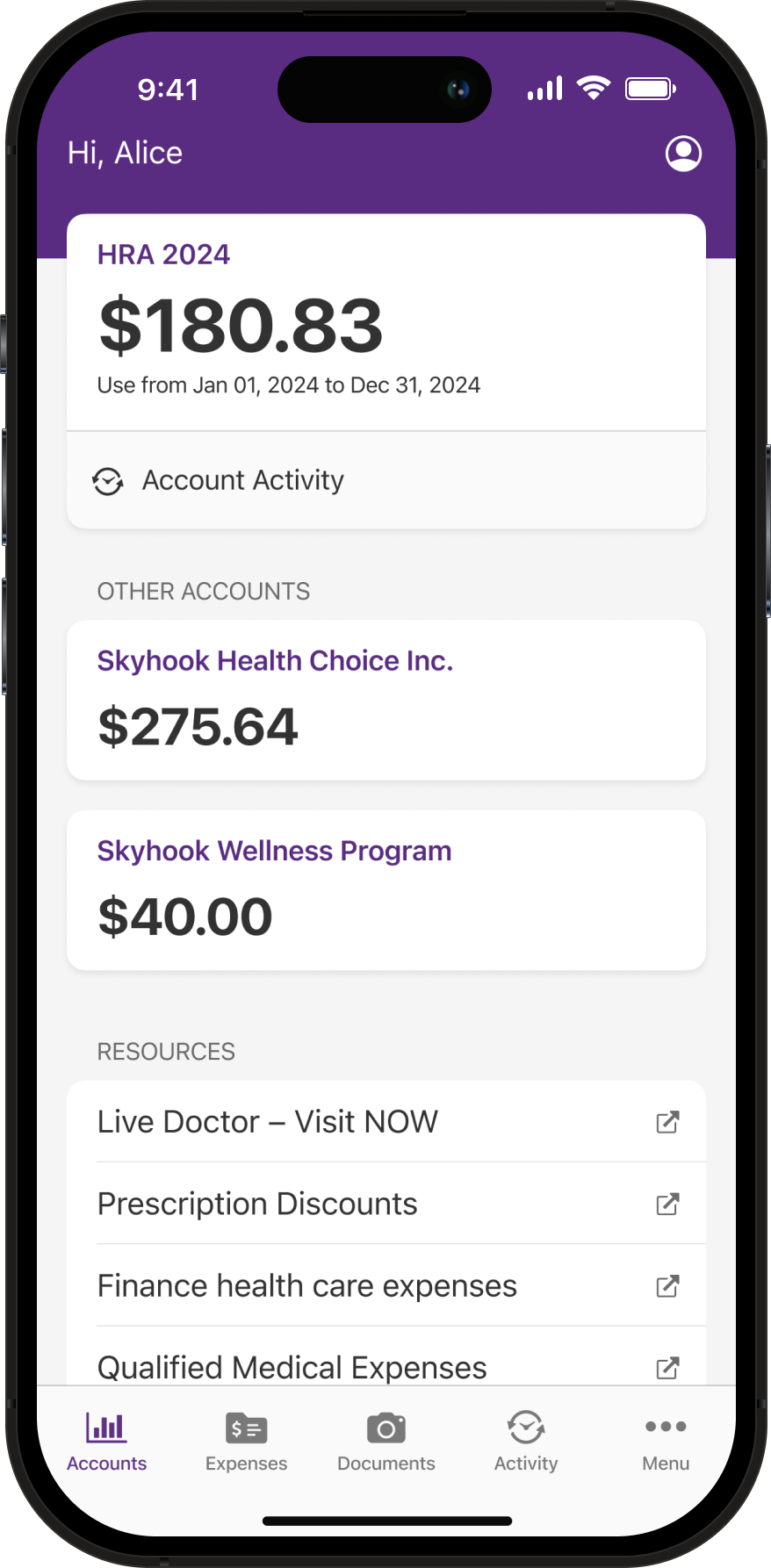

Mobile

Manage everything from the palm of your hand.

Convenient

Enjoy at-a-glance views of account balances, spending, claims status, and more.

Secure

Expect two-factor authentication and industry-standard encryption.

Are you an HRA-eligible employee?

Take advantage of your employer-funded benefit to pay for eligible expenses like deductibles, copays, and more. Check with your employer to see if HRAs are offered as part of their health benefits. What are the advantages of an HRA?

No payroll deductions

Tax-free reimbursement for HRA-eligible expenses

Easy HRA account management

People also ask

Employer HRA questions

-

What is considered an HRA-eligible expense?

You can use an HRA to set aside money to pay for all eligible healthcare expenses, including dental and vision expenses, as well as over-the-counter medications. Browse our full list of HRA-eligible expenses.

-

What is the difference between an HRA and a Health Savings Account (HSA)?

An HRA is an employer-sponsored plan, whereas an HSA is individually owned. Additionally, HSA eligibility requires enrollment in a high-deductible health insurance plan, while an HRA is compatible with most insurance plans. Compare HRA vs. HSA plans to see which is best for you.

-

What is the difference between an HRA and an FSA?

An HRA is an employer-sponsored plan, while an FSA allows employees and employers to contribute pre-tax dollars. Unlike FSAs, unused HRA funds may roll over at the employer’s discretion. Compare HRA vs. FSA plans to see which is right for you.

-

What is a Qualified Small Employer HRA (QSEHRA)?

A QSEHRA is an employer-funded benefit that is ideal for small business owners that can help employees cover medical costs.

-

What are the benefits of an HRA?

The main benefits of HRAs are that they don’t require any payroll deductions, and you don’t need to contribute any money. Meaning your employer funds the entire account. Also, your reimbursements for eligible expenses are tax-free.

-

What happens to unused HRA funds?

Unused funds are forfeited to the employer, usually at the end of the plan year. Learn more about HRA rules.

-

What happens to my HRA if I leave my employer?

Since your employer funds the HRA, your employer owns any amount that remains after you leave.

Read more about HRAs.

Browse our latest blog posts, guides, and webinars for ways HRA solutions support employees.

Article

HSA. FSA. HRA. HPA. LSA. What do all these even mean?

QME

HRA Qualified Medical Expenses

Webinar

HRA the easy way

HealthEquity does not provide legal, tax or financial advice.

COBRA/Direct Bill Employer login

Please refer to your Client Welcome email for the URL of your specific COBRA/Direct Bill Employer login page.

Follow us