For Business | Health Payment Account

Make healthcare more

affordable with HPAs.

We partnered with Paytient to offer a low-cost way to pay for care over time. HPAs alleviate the stress of medical bills with interest-free payment plans that break expenses, into smaller, manageable payments.

Cost-effective for you, budget-friendly for employees

A Health Payment Account (HPA) is a low-cost alternative for employers to help employees pay for healthcare. With HPAs, employees can get the care they need while staying flexible with their finances. HealthEquity members can even use tax-free HSA funds to repay payment plans for eligible expenses.

Why employers love it

When employers provide value-based benefits to employees, they may see:

- Increased productivity

- Higher employee satisfaction

- Better employee retention

Why employees love it

HPAs give employees immediate access to funds, which can lead to:

- Increased financial flexibility

- Reduced financial stress

- More opportunities to grow HSA balances

I can pick up medication and pay for doctor’s visits without fear of what the total will be. It relieves a lot of stress when it comes to healthcare.

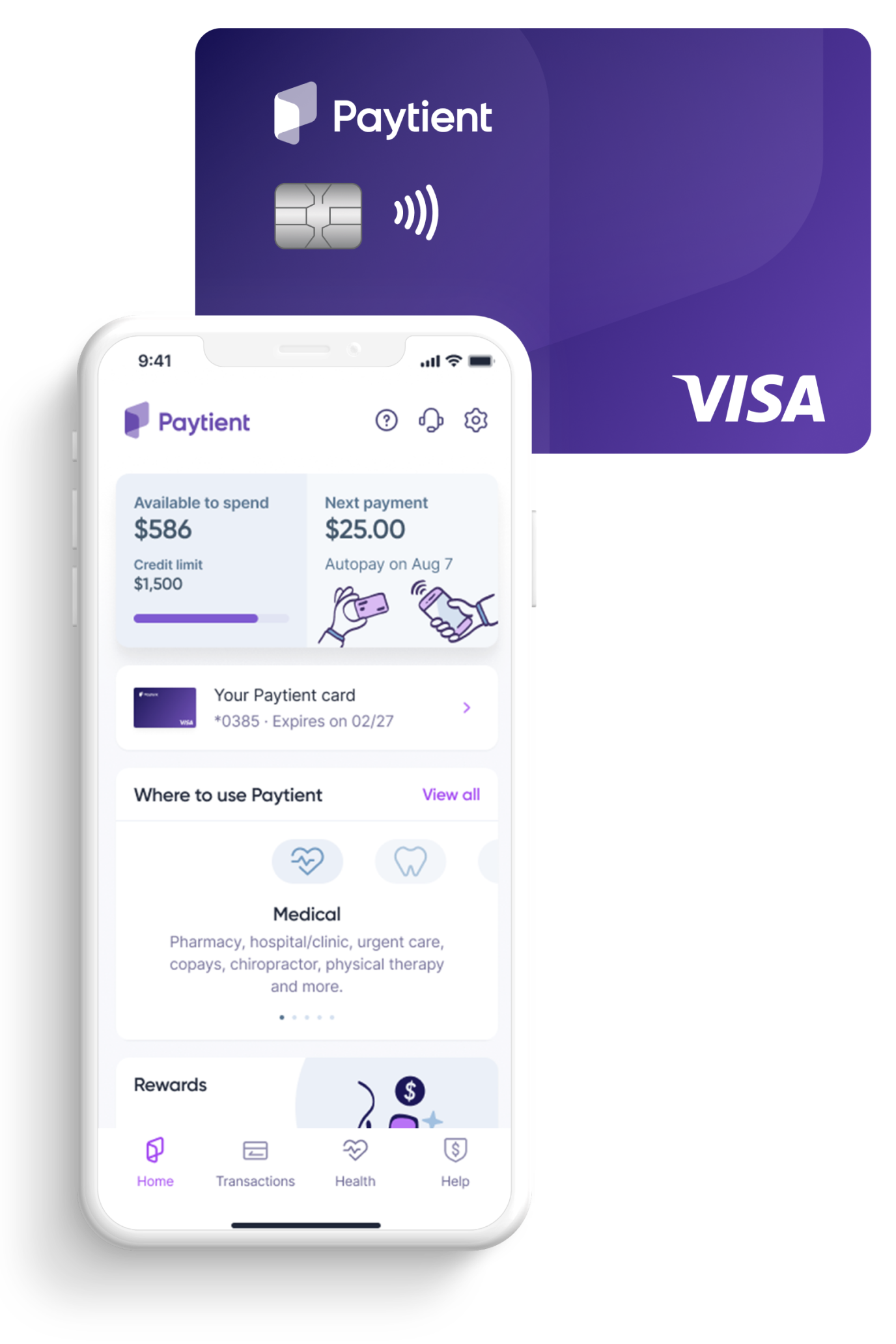

Employees can easily pay for care.

Here’s how your employees can use their funds to pay for out-of-pocket costs.

Sign up for Paytient.

Employees create a Paytient account, instantly activating their virtual HPA card.1

Pay for care.

Employees can use their card to pay for eligible out-of-pocket healthcare expenses for the whole family, even their pets.2

Choose a budget-friendly repayment plan.

To repay, employees split their balance into easy-to-manage payments automatically deducted from future paychecks, bank accounts, or HSA funds.

Ready to make healthcare more affordable?

People also ask

Employer HPA Questions

-

How does an HPA work?

An HPA is an interest-free, no-fee alternative payment option to pay for out-of-pocket healthcare expenses over time without high interest costs. For example, an employee visits an ear, nose and throat (ENT) doctor for a chronic sinus infection and has a $150 payment responsibility. At the time of service, members can activate their HPA benefit and pay using their HPA card. For each transaction, HPA members pick an interest-free payment plan that fits their budget and preferred payment source.

-

Who is eligible for an HPA?

An HPA is a benefit sponsored by employers, so they determine employee eligibility. HPA membership is tied to continued employment. If that employment ends, so does the employee’s continuing enrollment in an HPA as a benefit. But, if money is still owed to the HPA, it needs to be paid back, even if the employee is no longer employed by the sponsoring employer.

-

How does HPA repayment work?

When an employee establishes an HPA, they’re required to set up a default repayment method such as payroll deduction or personal checking/banking account. Monthly payments are then deducted from the designated repayment method.

-

What if an employee leaves my company and owes a balance?

Employers are not responsible for collecting HPA balances. If an employee leaves your organization, they will no longer be able to make new charges on the HPA. Paytient will contact those individuals directly to figure out the best way to continue repaying any outstanding balances.

-

Does a member have to fully pay off the HPA balance before starting a new plan to pay for a new expense?

No, the available amount on the HPA can be used to set up a new, overtime payment plan. For example, a plan has a $1,000 limit, and currently has a remaining balance due of $300. An additional $700 is available to begin a new charge repayment plan.

-

Where can my employees use an HPA?

Employers have the flexibility to determine how HPAs are used for medical, dental, pharmacy, vision, and/or veterinary expenses at both in-network and out-of-network providers.

The HPA card will not work for other expenses, such as groceries, gas, etc. HPA cards work at most providers that accept Visa if the merchant bills to a covered category, like medical or dental.

Rarely, a provider might be owned by another company with a different merchant category that isn’t included in the program. In those cases, employees can contact the Paytient customer support team for help. -

How much does this cost my employees?

Nothing. Employers pay a simple subscription to make HPAs available to their employees. Members pay back what they spend on their HPA and not a penny more!

-

Can employees adjust their HPAs?

Account holders may be able to adjust payment plans to fit their budgets better. They can do so by emailing hello@paytient.com for assistance.

-

Can an HPA pay for previous medical bills?

Yes. An HPA can cover bills still owed to providers if they are not already being collected by a different party. Simply use the HPA Visa card as the payment method, then plan payments with the HPA app.

1The HPA card is a line of credit that is subject to approval and works with providers in approved merchant categories. All charges made to the HPA card must be repaid according to the terms outlined in the cardholder agreement.Return to content

2HPA funds can be used for veterinary expenses. Generally, HSA funds cannot be used for veterinary expenses. Please consult with a tax or legal professional to see if your HSA funds can be used for paying any HPA balance from veterinary expenses.Return to content

V.S.A. §2220a. THIS IS A LOAN SOLICITATION ONLY. HEALTHEQUITY PAYMENTS, LLC IS NOT THE LENDER. INFORMATION RECEIVED WILL BE SHARED WITH ONE OR MORE THIRD PARTIES IN CONNECTION WITH YOUR LOAN INQUIRY. THE LENDER MAY NOT BE SUBJECT TO ALL VERMONT LENDING LAWS. THE LENDER MAY BE SUBJECT TO FEDERAL LENDING LAWS. (Added 2017, No. 22, § 25.)

COBRA/Direct Bill Employer login

Please refer to your Client Welcome email for the URL of your specific COBRA/Direct Bill Employer login page.

Follow us